Getting a Texas insurance license is often the first step if you want to pursue a career as an insurance professional in the Lone Star State. Just like in other states, the process isn’t always straightforward and requires you to meet stringent criteria.

To guide you through your journey, Insurance Business gives you a walkthrough on how to get an insurance license in Texas. We'll go over the different roles that require one, the licensing requirements, and what it takes to retain your license.

If you want to practice as an insurance producer or adjuster in Texas, this guide can prove handy. Read on and find out the steps you need to take to obtain your Texas insurance license.

All insurance producers and claims adjusters who wish to practice in Texas are required to get the corresponding licenses. Before you can do so, the Texas Department of Insurance (TDI) has laid down the following eligibility criteria:

Here’s a step-by-step guide on how to secure your insurance license if you want to become an agent, broker, or adjuster in the state.

You have several options if you want to pursue an insurance career in the state. According to the TDI, three of the most common licenses that insurance professionals apply for in Texas are for:

Once you’ve decided on a career path, you can proceed to the next step. If you need more information about these roles, these guides on how to become an insurance producer and what it takes to become a claims adjuster can help.

Unlike in other states, Texas doesn’t always require aspiring insurance agents and brokers to complete a pre-licensing course. This means that preparing and studying for the state licensure examination is entirely up to you.

These tests, however, aren’t easy. The latest data from Pearson VUE – TDI’s exam administrator partner – shows that for the three most common licensure exams, the passing rates are:

These figures show how important ample preparation is to pass the test.

Aspiring insurance agents can also apply for a temporary license prior to taking the state exam if their sponsoring company or agency requests it. Applicants, however, must complete 40 hours of pre-licensing education within 14 days of their application for a 90-day temporary license and within 30 days for a 180-day license.

Claims adjusters, meanwhile, must finish 40 hours of pre-licensing coursework prior to taking the licensure test.

Pearson VUE has prepared this insurance content outline to guide aspiring insurance professionals on what topics to study for the state exam.

The most efficient way for you to schedule your examination is to book it online on Pearson VUE’s website. You must do so at least 24 hours before your preferred test date. The same goes if you want to make a phone reservation. You can contact the exam administrator at (888) 754-7667 to book a slot.

You will be asked to provide the following information:

You will also be charged a testing fee, which varies depending on the type of exam. The fee for the three types of licenses mentioned above – LA&H, P&C, and all lines adjuster – costs $43.

The exam administrator reminds all applicants that walk-in slots are not available. There are also no examinations scheduled during these holidays:

Holders of temporary licenses must take the exam before their insurance licenses expire.

The Texas insurance licensure exam covers a range of topics, making it among the most difficult tests to take. Depending on the insurance line, the exam may contain 50 to 200 items that you need to answer within one to three hours. The passing score is 70%.

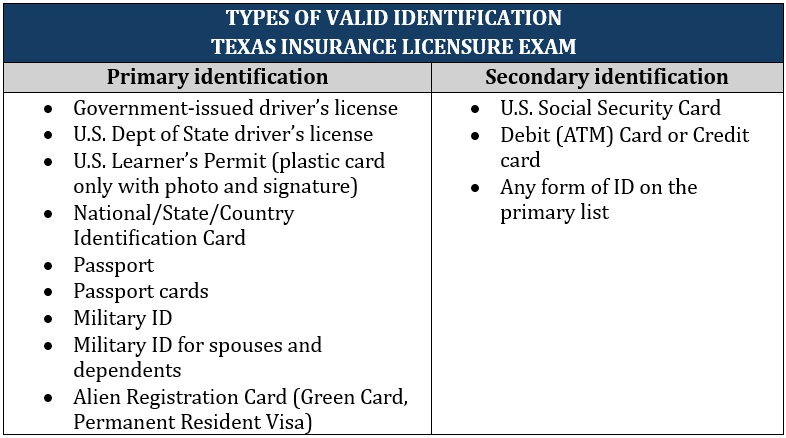

Be at the testing site 30 minutes before your scheduled test to give time for check-in procedures. You will be asked to provide two valid IDs, with at least one that’s government-issued and bearing your photo and signature. All IDs must be in English.

Here’s a list of the types of identification you can present:

Latecomers and those who fail to present the necessary identification documents will not be allowed to take the test. Their testing fees will be forfeited.

The exam administrator allows latecomers and absentees to request for a change of schedule within 14 days for the following reasons:

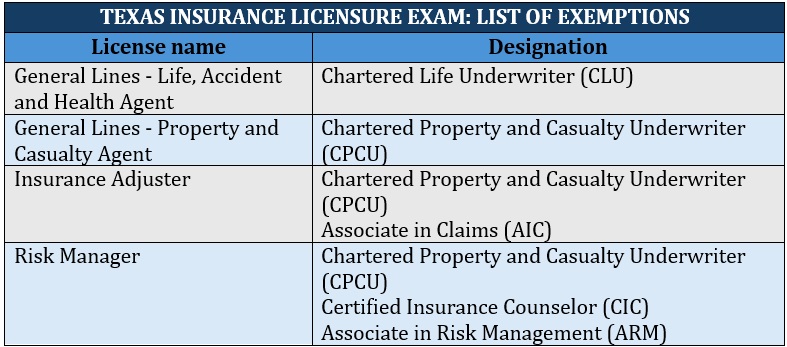

There are also insurance professionals with certain designations who can skip the state exam:

Non-resident insurance license holders from states that Texas has reciprocal agreements with are also not required to take the state licensure exam.

All insurance license applicants in Texas must provide fingerprints prior to licensing to start a background check. You can set up a fingerprinting appointment through the IdentoGo website or by calling the identity solutions provider at (888) 467-2080.

The fee for fingerprinting services is $39.70.

Make a reservation 24 hours in advance. Note that you will not receive a printed fingerprint card. Your fingerprints and photo will be sent directly to the Department of Public Safety (DPS) and the Federal Bureau of Investigation (FBI) for background checks. Any misdemeanor or felony charges may impact your eligibility for a Texas insurance license.

Once you’ve passed the exam and successfully completed a background check, you can now apply for your license. You have 12 months after the release of the test results to apply for a license. If you want to get a license in different lines of authority, you must submit the applications separately. Each submission costs $50.

You can apply for a license on the Sircon or the National Insurance Producer Registry (NIPR) websites.

The TDI will review your license application and your background check. The process can take between three and five weeks. If something comes up from the background check, the department may contact you for an explanation. This can slow down the process.

The TDI will inform you of the status of your application through email. If approved, your Texas insurance license is valid for two years. Once it expires, you will need to have it renewed.

Some licenses require 24 hours of continuing education (CE) to be eligible for renewal. This includes three hours of ethics-related training. At least half of the CE credits must be taken in a classroom.

If you wish to pursue an insurance career in Texas, whether as a producer or an adjuster, there are certain steps you need to take. Here’s a summary of the entire process:

Once approved, you need to renew your license and complete certain hours of continuing education every two years.

Testing fees for the Texas insurance licensure exam cost between $23 and $43, depending on the type of license you’re taking the test for. Fingerprinting services cost around $40, while the license application fee is $50.

These three processes together can cost you around $113 to $133. This amount doesn’t include fees for taking pre-licensing coursework, which is required for adjusters and agents with temporary licenses. It also excludes fees for continuing education.

Your Texas insurance license is valid for two years. You need to renew your license after this period. Typically, you’re required to take 24 hours of continuing education to qualify for license renewal. You must also settle any fines or fees that are due.

The TDI bars anyone who has been convicted of a felony or has engaged in fraudulent or dishonest activities from getting an insurance license.

One of the reasons that makes a career in insurance enticing is the strong earning potential that comes with it. Insurance agents and adjusters can earn income in a variety of ways, including commissions, salaries, and profit sharing.

How much they make, however, depends on how successful they are in establishing relationships with clients. Their commitment and hard work also have a major impact on their earnings.

If you’re planning to put up an insurance business instead and wondering what types of insurance agency licenses are required, this guide can help.

What do you think about the process of getting a Texas insurance license? Is getting an insurance license in Texas worth it? Chat us up in the comments section below.