![]()

![]()

*Twitter share button is not available on your current browser.

Nomura Holdings, Inc.

Tokyo, August 3, 2022 - Nomura Holdings, Inc. today announced its consolidated financial results for the first quarter of the fiscal year ending March 31, 2023.

Net revenue in the first quarter was 299.0 billion yen (US$2.2 billion) 1 , income before income taxes was 11.7 billion yen (US$86 million), and net income attributable to Nomura Holdings shareholders was 1.7 billion yen (US$13 million).

"Although our overall group performance was impacted by an unrealized loss on securities holdings amid interest rate and market volatility, we saw the positive results of our strategic initiatives and revenue diversification progress in our core businesses," said Nomura President and Group CEO Kentaro Okuda.

"In Wholesale, Global Markets reported higher Fixed Income revenues amid a spike in interest rate and FX volatility. In Investment Banking, Advisory revenues increased year on year as a result of multiple cross-border mandates and sustainability deals responding to the diversified needs of our clients.

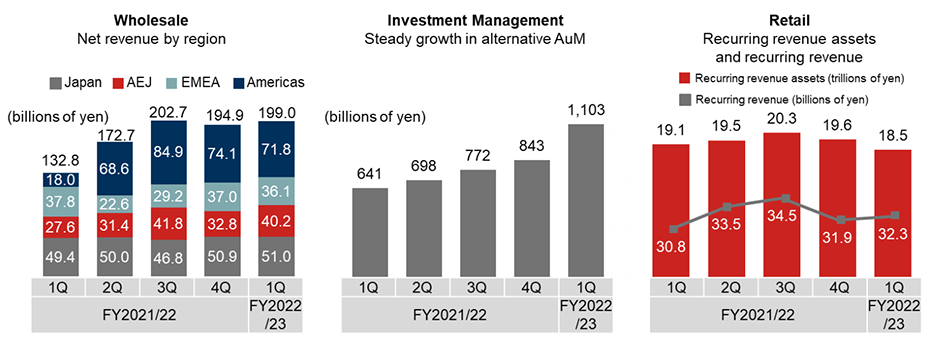

"Investment Management booked continued inflows mainly from the investment trust business, contributing to solid business revenue in line with last quarter’s performance. Alternative assets under management surpassed 1 trillion yen, driven by continued momentum in our strategic business initiatives.

"Although market uncertainty kept investors in wait and see mode, Retail reported growth in recurring revenue driven by discretionary investment contracts, level fees and loans, as we made steady progress in the shift towards asset consulting over the medium to long-term.

"We remain committed to delivering sustainable growth."

1 US dollar amounts are included solely for the convenience of the reader and have been translated at the rate of 135.69 yen = 1 US dollar, the noon buying rate in New York for cable transfers in foreign currencies as certified for customs purposes by the Federal Reserve Bank of New York on June 30, 2022. This translation should not be construed to imply that the yen amounts actually represent, or have been or could be converted into, equivalent amounts in US dollars.

| (Billions of Yen) | FY2022/23 Q1 | QoQ | YoY |

|---|---|---|---|

| Net Revenue | 71.4 | 1% | -16% |

| Income (loss) Before Income Taxes | 4.9 | -5% | -74% |

Retail reported net revenue of 71.4 billion yen, increasing 1 percent quarter on quarter and down 16 percent from the same period last year. Income before income taxes was 4.9 billion yen, down 5 percent quarter on quarter and 74 percent year on year.

Retail delivered consulting services tailored to the needs of clients, resulting in net inflows into recurring revenue assets driven by discretionary investments, level fees and loans. Recurring revenue increased slightly from the previous quarter to 32.3 billion yen despite market headwinds. Level fee assets exceeded 200 billion yen at the end of June following a full launch in April.

| (Billions of Yen) | FY2022/23 Q1 | QoQ | YoY |

|---|---|---|---|

| Net Revenue | 7.6 | -25% | -88% |

| Income (loss) Before Income Taxes | -11.7 | - | - |

Investment Management first quarter net revenue was 7.6 billion yen, down 25 percent quarter on quarter and 88 percent year on year. Loss before income taxes was 11.7 billion yen.

Management fees were roughly the same as the previous quarter driven by continued inflows primarily into the investment trust business, and business revenue was 30.7 billion yen, down 2 percent quarter on quarter but up 9 percent year on year. The bear market and interest rate hikes led to an American Century Investments related loss of 18.5 billion yen and an unrealized loss on Nomura Capital Partners investee companies of 4.7 billion yen. As a result, investment revenue was negative 23.1 billion yen.

| (Billions of Yen) | FY2022/23 Q1 | QoQ | YoY |

|---|---|---|---|

| Net Revenue | 199.0 | 2% | 50% |

| Income (loss) Before Income Taxes | 25.3 | -32% | - |

Wholesale booked net revenue of 199.0 billion yen, higher by 2 percent quarter on quarter and 50 percent year on year. Income before income taxes was 25.3 billion yen, decreasing 32 percent from last quarter.

Global Markets net revenue was 175.3 billion yen, an increase of 11 percent from the prior quarter and 80 percent year on year. Fixed Income delivered a robust performance mainly driven by Macro Products amid a spike in interest rate and FX volatility, offsetting a slowdown in Equities revenues on lower trading volumes as market participants adopted a wait-and-see approach.

Investment Banking net revenue was 23.7 billion yen, down 35 percent quarter on quarter and 33 percent year on year. While Finance performance slowed amid a decline in global transactions, Advisory revenues grew stronger compared to the same period last year on the back of multiple cross-border mandates and sustainability deals.